Businesses in the twenty-first century have to be at the leading edge of technological advancement if they hope to be competitive and seamless in operations. This includes payment processing technology. Given the rapidly evolving landscape of consumer expectations and innovations at every turn, the business world is critical for continually checking and upgrading payment technology. In terms of transaction efficiency, customer satisfaction, or security, the benefits are numerous. Here is the comprehensive guide to assessing your practical needs and upgrading your payment processing technology.

Assessment of Current Needs in Payment Processing

First, take a closer look at your current payment processing setup. Go through your present system’s performance with respect to speed, reliability, and user experience. Highlight pain points or inefficiencies: high transaction fees, too many system downtimes, or not being integrated with other business tools. Consider your company’s growth projection—the likelihood that the current technology will scale to meet that. Understanding your current needs and limitations will let you pin down gaps and areas for improvement.

Research Trends and Innovation in the Industry

Stay informed about the evolving landscape of payment technology. The payment industry has been changing continuously; the current trends appear to be heading toward no-contact, mobile wallet, and blockchain technologies. Research new technologies and their potential advantages, including enhanced security features, faster transaction times, and easier integration. Assess how these innovations align with your corporate goals and the preferences of customers. Keeping up with industry trends will keep you informed on the adoption decisions of various technologies.

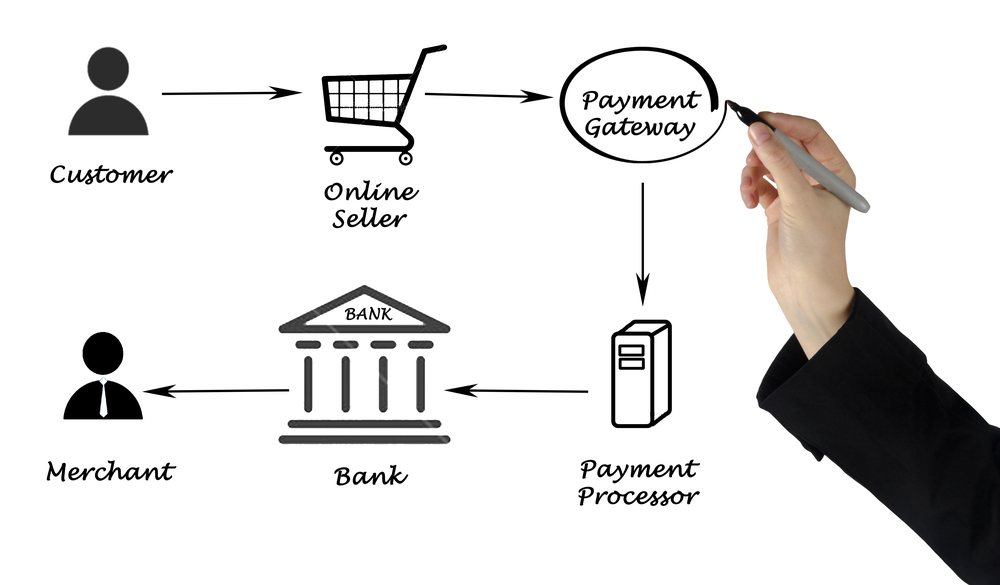

Processors and Gateways Evaluation

While switching to a new process, seek out the most suitable payment processor companies and gateways for your business. Look for vendors that will have features ideal for your needs, such as multi-currency support, advanced fraud detection, and integration that is easy and smooth with the applications of choice. Review the exact charges per transaction and other setup costs. Know how customer support is delivered. You can also find out about the reliability and performance of different providers from reviews and recommendations of peers in the industry.

Focus on the issues of security and compliance.

Security in payment processing is paramount. Ensure that the new technology adopted complies with relevant standards and industry regulations, such as the Payment Card Industry Data Security Standard. Ensure that it includes features to protect customer sensitive data, such as encryption, tokenisation, and other secure authentication methods. To keep safeguarding your payment systems from new threats, update and patch them regularly. When done right, strong security not only protects your customers but also helps in avoiding huge losses from data breaches and fraud.

Integration and Compatibility Planning

Understand how new payment technology will dovetail with other existing systems that you use in your operation, including but not limited to an e-commerce platform, accounting software, and CRM tools. Seamless integration will reduce the effort required for operations while supporting uniformity across your business. Work with technology vendors to understand the options for integration and any possible problems that may be encountered. A well-integrated payment system will boost your efficiency and offer you a unique view of your financial transactions and customer interactions.

Pilot test new solutions.

Pilot and comprehensively test payment technology before fully supporting it. Perform a trial to gauge the technology’s performance, reliability, and user experiences. Engage a few staff members or customers to help you gather feedback and identify any issues that require improvement. It enables you to determine how well the technology suits your requirements and assures a seamless transition before a full rollout.

Train Staff and Make Changes Known

Now that you have selected and installed new technologies for payment, ensure that necessary training is provided to your staff so that employees are comfortable with the new system and can fix any hitches. Proper training will help you minimise the interruptions you might face and maximise the numerous benefits of this new technology. It is also crucial to communicate the change to your customers, especially if the upgrade will affect their payment experience. This way, you will manage their expectations and have peace of mind in the safety and efficiency of the new system.

Watch performance and Iterate.

Monitor the performance of new payment technology once it has been rolled out, and get user feedback on it. Track key metrics that would include times for transactions, error rate, and customer satisfaction. Periodically review these metrics to find shortcomings and areas for change to make relevant changes. Technology is ever-changing; similarly, so are your customer preferences. Thus, it becomes crucial to be adaptable and continually upgrade your systems to keep them in optimal shape.

Conclusion

In today’s fast-paced business environment, operational efficiency and staying competitive are mostly about evaluating and upgrading your payment technology. Assess your current needs against industry trends and evaluate payment processors. Prioritise security, plan for integration, test new solutions, train staff, monitor performance, and you will upgrade your payment processing technology. This approach ensures that your payment systems are efficient, safe, and compatible with evolving industry standards, supporting business growth and success by improving the overall customer experience.